Uhuru, Nyoro blamed for debt crisis, MP says Kenyans to shoulder Sh1 trillion interest burden

The Alego Usonga MP, who took over as BAC chairperson from Nyoro earlier this year, accused his predecessor of presiding over unsustainable borrowing without directing funds to impactful development.

The Budget and Appropriations Committee (BAC) has slammed former President Uhuru Kenyatta’s administration and ex-chairperson Ndindi Nyoro for reckless borrowing, warning that the legacy of heavy debt will saddle taxpayers with over Sh1 trillion in interest repayments in the coming financial year.

According to committee chairperson Samuel Atandi, the borrowing spree between 2014 and 2022 under President Uhuru severely undermined the country’s economic growth and compromised its ability to finance critical development programmes.

More To Read

- Kenya not at risk of defaulting – Mbadi dismisses Nyoro’s claims on debt as irresponsible

- Kiharu MP Ndindi Nyoro raises alarm over rising debt, warns of possible default

- National Treasury allocates Sh3 billion for public budget forums in counties

- Ousted MPs ordered to vacate offices as new committee leaders take over

- Ndindi Nyoro: No one consulted me before my removal as budget chair

- ODM MP Sam Atandi replaces Ndindi Nyoro as Budget Committee chair

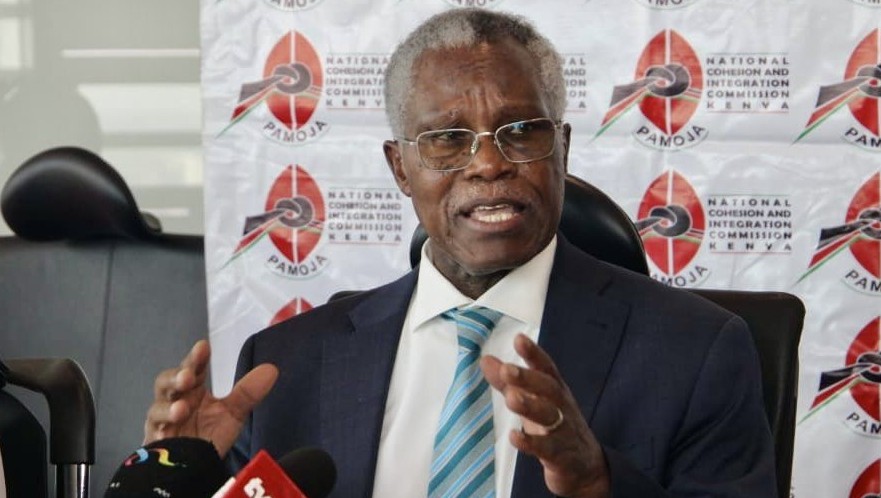

“President Uhuru's administration mismanaged our economy through heavy borrowing, and individuals who served in that regime should not lecture us,” Atandi said while addressing a press conference at his office at the Kenyatta International Convention Centre (KICC).

He added that the country will, for the first time in its history, spend more than Sh1 trillion on interest repayments alone starting July 1.“This is a lot of money that should have been used on development.”

“If Uhuru never mismanaged the economy, we would not be spending Sh1 trillion. Please, be ashamed of yourselves. What did you do with the Sh10 trillion that you borrowed?”

The Alego Usonga MP, who took over as BAC chairperson from Nyoro earlier this year, accused his predecessor of presiding over unsustainable borrowing without directing funds to impactful development.

“Nyoro presided over the heavy borrowing during his tenure as BAC chairman. I want those who served in the Uhuru administration to stop tribal bigotry in the sharing of public resources,” Atandi said.

Kiharu MP Ndindi Nyoro. (Photo: X/Ndindi Nyoro)

Kiharu MP Ndindi Nyoro. (Photo: X/Ndindi Nyoro)

His remarks come in response to recent claims by Nyoro that the current administration is borrowing against fuel tax revenues without Parliament’s consent. Nyoro had alleged that the securitisation of the Roads Maintenance Levy Fund (RMLF) is a brewing scandal.

In response, Atandi defended the Treasury, stating that the government has used the fuel levy to pay at least 40 per cent of pending bills owed to road contractors, prompting the resumption of stalled works.

“The government has been able to pay at least 40 per cent of pending bills owed to road contractors who have now embarked on works across the country after abandoning the same,” he said.

The Treasury recently secured Sh78 billion in short-term financing from commercial banks, backed by proceeds from the RMLF, which is levied at Sh10 per litre of fuel. It targets raising Sh175 billion annually through securitisation to enable the Kenya Roads Board to access cheaper financing.

Atandi maintained that while borrowing is sometimes necessary, future debt must be taken responsibly. “While debt is unavoidable, we must borrow prudently going forward.”

According to Atandi, interest payments on public debt have increased drastically from Sh171 billion in 2014, just a year after President Uhuru took over from the late Mwai Kibaki, to Sh840 billion in 2022. Over the same period, development expenditure stagnated at Sh530 billion.

Data from the Institute of Public Finance (IPF) shows that in the current financial year, Kenya spent Sh1.2 trillion on interest payments alone, part of a broader debt servicing obligation totalling Sh1.85 trillion, including Sh843.4 billion in debt redemption. This means about 33 per cent of the national budget went to domestic debt servicing.

Atandi further noted that Kenya’s public debt has reached a record Sh11.35 trillion, up from Sh10.4 trillion in March last year, amid increased borrowing by President William Ruto’s administration from domestic sources such as banks, insurance funds and pension schemes.

To mitigate the growing burden, Atandi said BAC will prioritise budget cuts on non-essential expenditures in the upcoming 2025/26 financial year to free up funds for development.

“Beginning Thursday, BAC will be meeting with the chairpersons of Departmental Committees to receive the reports from various ministries, departments and agencies (MDAs) for the financial year 2025/26,” he said.

He assured the public that the resulting budget will be inclusive and fair. “I want to assure the country that even as we undertake budget cuts, we will deliver a budget that is equitable, fair and covers all parts of our country. We will not deliver a partisan budget like has been the case, where only one region benefited.”

The Departmental Committees are expected to present their respective ministry budgets to the BAC, which will consolidate them into the national budget and table it in Parliament for approval.

Top Stories Today